The Insights Family looks at the rise of Korean culture and its impact on the licensing industry.

With modern day resources, connecting with your favourite media, content and communities of like-minded fans is easier than ever before. No longer do consumers have to travel to view Italian cinema, US rap music concerts or Premier League football games in the UK.

Barriers to access are generally decreasing worldwide, as large scale commercially viable strategies are adopted to ensure the success of country-sized cultural exports.

The growing buzz around Korean cultural exports did not happen overnight. A number of contributing factors have combined to form one of the world’s most contagious cultural phenomenons or Hallyu – ‘Korean wave’ – as it has become known. In the 1990s there was a conscious effort from the country’s government to invest resources into the entertainment industry, citing one global blockbuster film potentially reaching the equivalent sales of a million Korean-manufactured cars as an incentive comparison. This provided a suitable environment for success by providing an encouraging policy framework and incentive-based infrastructure.

The virality of music on social media, in combination with the globalised nature of the internet has meant that now, kids are consuming more music from other countries than ever.

Korean group BTS have been the number one artist among tweens and teens across the world for a year now. Their popularity has since aged down to reach younger kids and they are now also the top artist among 3-9 year olds globally. In the UK specifically, they rank as the number 17 most popular celebrities among teens aged 13-18. Blackpink are another K-pop group capitalising on this new online audience, as they are now the third most popular artist among 6-15s globally.

K-pop has extended beyond the music industry. K-idols create worlds surrounding themselves that fans can get immersed in. Many groups including BTS also produce TV shows for their fans to follow their lives. There are also many types of merchandise surrounding K-idols, including toys, clothes and stickers. These forms of interaction resonate with audiences beyond Korea. In the UK, teens aged 13-18 who pick BTS as their favourite celebrities are +249% more likely to purchase toys related to their favourite TV shows. By having touch points across different industries, there is lots of opportunity for licensed products and experiences.

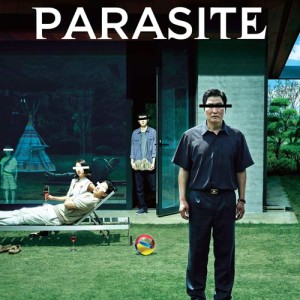

The country has been thriving in other entertainment industries too. Korean cinema has enjoyed success on the global stage – 2019’s Parasite becoming the first non-English language film to win Best Picture at the Oscars. The country is continually the source of new television formats also, the most prominent contemporary example being in the form of The Masked Singer. Originally airing in South Korea in 2015, iterations now exist in 16 countries, including the US, Mexico, the UK and Germany, with variants of the format slated for release in 17 additional countries including Australia, France, Spain, Brazil and Italy.

The country has been thriving in other entertainment industries too. Korean cinema has enjoyed success on the global stage – 2019’s Parasite becoming the first non-English language film to win Best Picture at the Oscars. The country is continually the source of new television formats also, the most prominent contemporary example being in the form of The Masked Singer. Originally airing in South Korea in 2015, iterations now exist in 16 countries, including the US, Mexico, the UK and Germany, with variants of the format slated for release in 17 additional countries including Australia, France, Spain, Brazil and Italy.

One recent example of South Korea’s on-screen cultural exports has been the success of Squid Game – the show initially shot up in popularity among teens globally since its release in 2021. It is still the number four most popular TV show among kids aged 13-18 in the UK (7%). Fans of the show are +29% more likely than the average kid to say they value being the first to know about the latest news and products. This suggests that the avid fans of Korean culture outside of Korea are at the front of trends, meaning they look for the next big thing. Releasing new merch and licensed items will resonate with this audience.

South Korea has also been at the forefront of new innovations that are becoming established in the West, one of the biggest examples being the case of esports. Korean kids aged 13- 15 are +27% more likely to watch esports than the global average.

The infrastructure developed for professional gaming has incubated in the country since the early 2000s. Professional Starcraft: Brood War has been broadcast on television since 2003, prior to the creation of online platforms such as Twitch. As such, players from the country are extremely dominant in the space. Globally, League of Legends is the number one esport for kids between the ages of 3-18 and over 50% of the 11 world championship tournaments have been won by Korean teams. As the industry continues to grow, the country’s cultural presence will increase with it.

Korea’s high degree of success with regard to global appeal highlights the importance of a country’s ‘soft power’, meaning its influence across imagery and associated culture. Now that we see kids becoming even more receptive to non-domestic IPs across a multitude of industries, the opportunity has never been greater to expand brand revenue streams overseas.

For licensors and licensees, riding the Korean wave will attract a wider audience and keep fans engaged with new products and trends.

The Insights Family is the global leader in kids, parents and family market intelligence, providing real-time data on their attitudes, behaviours and consumption patterns. Kids Insights surveys 7,780 children every week aged 3-18. Parents Insights surveys more than 3,800 parents of children between the ages of 1 and 16 every week. Both services operate in 22 countries across six continents and in total survey more than 469,040 kids and 228,800 parents a year. This means that the company interviews a new family member somewhere in the world every 45 seconds.

This feature originally appeared in the autumn 2022 edition of Licensing Source Book. To read the full publication, click on this link.