“Consumers’ awareness and their expectations of responsible and ethical practices from retail brands and governments are driving change,” Richard Lim, ceo of Retail Economics tells SILC attendees.

On the second day of SILC (25 June), Richard Lim, ceo of Retail Economics – an independent research consultancy focused on the consumer and retail industry – shared his views on the major impacts of Covid-19 on the retail sector, and how they have translated to the sustainability agenda for retail boards around the UK, with Richard revealing how the pandemic has had an enormous impact on retail.

“It has had a huge impact on digital and the customer journey right from the very beginning, from awareness right through to service and returns,” he emphasised.

The company’s research has revealed that around 40% of consumers bought something online for a category that they had previously only ever looked for in store. “This was a huge wave of new customers getting over those barriers of setting up online accounts, entering payment details, overcoming the issues of trust, and it has created a wave of disruption across the retail sector in a way that retailers need to operate, and in the way that they source products, but also in the relationships that they have with their customers.”

He said that early in the pandemic, it felt as though concerns around sustainability were at risk of falling down the priority list as retailers went into survival mode to protect their businesses.

“But as the shock of the pandemic began to recede, companies and governments have been starting to look back, looking at ways to build back better, putting sustainability at the heart of their plans. In fact, I think that retail is in the middle of a paradigm shift, and part of this is, because the true extent of the pandemic, is still to emerge. Government supported measures are still in place, backed by loans, and the furlough scheme is still running. But as the government starts to withdraw some of those supportive measures, it’s inevitable that retailers will face issues re continuing to trade.”

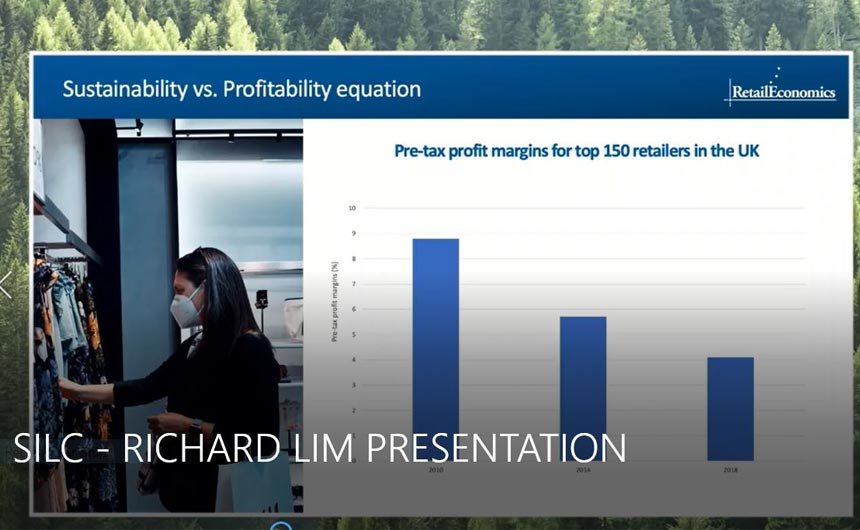

He said that one of the major and critical factors that will affect the retail trade going forward is when the true cost of online begins to be revealed. “This is about the huge shift towards the digital space that will create challenges around profitability, and the challenge for many retailers will be how to maintain that balance between profitability while also maintaining their pledges around ESG,” he pointed out. “There’s nothing new about the balance between companies wanting to do the right thing in terms of sustainability, and a commercial reality of remaining profitable, so I think the pandemic is going to put much more pressure on balancing this equation, at least during the transitionary period.”

Putting this into context, Retail Economics looked at pre-tax profits for the top 150 retailers over the past decade, which revealed that pre-tax profits across the industry have basically halved over that period, falling from around 8% to 4%.

He said that in part, it had been driven by a more competitive sector, and by international players that have entered the UK market. But it had also been driven by a shift towards online, and retailers having to adapt to a different business model.

“That shift towards online has occurred at a terrifying pace,” he highlighted. “Looking at some of the latest data, we’ve seen a step change in the proportion of online sales. In 2019, online sales accounted for 19%. In 2020, this grew to 28%, and over the past five months, the proportion of online sales for the sector has risen to around 32%. However, we are expecting this to fall back a bit, because of restrictions around the first quarter of the year and lockdowns, so if there are no further lockdowns going forward then the proportion of online sales will slip back.”

Richard’s view is that many retailers will be caught up in having to deal with the shift to online, exposing cost structures that are overly weighted towards a physical presence. While those fixed costs remain, related to expansive store estates, retailers will also have to deal with a rise in variable costs associated with a greater proportion of their sales moving online.

“Many retailers will therefore be left with physical outlets that they can’t commercially justify, and these will often by tied to inflexible lease structures which will inhibit their ability to pivot business models fast enough to be able to effectively manage the change,” he explained. “At the same time they will also have to invest heavily in making their online operations more efficient. This could be anything from automating warehouse distribution to hiring more data scientists to integrate more sophisticated social media campaigns, with the digital shift creating new challenges across the entire value chain, adding costs at each stage of the process. This transitionary period will prove challenging for industry, and that profitability will come under pressure, with the true cost of online revealed across parts of the sector.”

Highlighting recent research undertaken by the company, he said that in the UK, pre-tax profits could fall as low as 3% in five years’ time, putting huge pressure on retailers to protect profitability while simultaneously looking at how they can build back and manage the process by keeping sustainability playing a leading role.

Arguably, he believes that the onus will lie with business leaders having to figure out the right balance between short term and long-term priorities, but that, in the long term, he remains optimistic. “We think that protecting profitability and also keeping sustainability high up the agenda are not mutually exclusive.”

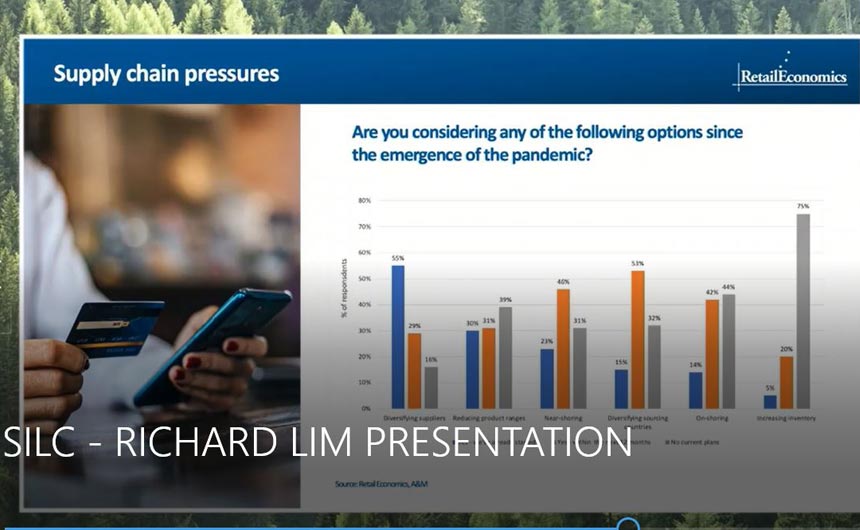

Meanwhile, three emerging trends, that he believes will resonate over the coming years, have been revealed by the pandemic. He said the crisis had highlighted that the globally diverse and complex, but fragile, supply chain was only as strong as the weakest link, and that new supply chain sectors that emerge to try to build more resilience into these supply chains will also be looking at how they can keep their sustainability pledges.

“For example, strategies are likely to involve shorter and more flexible, resilient supply chains that are better in dealing with these shocks. Often that will mean bringing them closer to home with things like near-shoring and long-shoring. But some of the key things will be around simplification, to include near-shoring, on-shoring and potentially re-shoring, diversifying the number of countries supplying.”

He highlighted that retailers are therefore looking at not being over reliant on one country, with China being the obvious example. He forecasts a China + 1 and a China + 2 model. Richard also anticipated re-thinking inventories to establish other supplier routes and looking at how to fast track some of those volumes and deliver better capabilities and capacity, as well as understanding the costs to serve, with supply chains potentially shifting towards more on-shoring and near-shoring.

“There will be an impact on the cost base, and it’s therefore important for retailers to recognise what kind of impact that’s going to have on things like pricing strategies,” he commented.

Highlighting further research done by the company, retailers covering some 500 billion euros worth of sales were asked what kind of strategies they were looking at in terms of supply chains as a direct consequence of the pandemic, with near-shoring and on-shoring becoming very important over the next 12 months. The same research also revealed that the retailers were planning on changing the way that they sourced products in order to help to meet ESG goals. Some 70% of the retailers said that they were already doing this, with 30% of the retailers confirming that they were planning to do more of this. Retail Economics also found that 40% of the retailers surveyed had planned to source more from domestic economies to try to meet the ESG objectives.

“Generally, this is fantastic news, as around 22% of global greenhouse gas emissions are attributable to the production and distribution of traded goods consumed abroad,” said Richard. “Around a third of that is directly linked to trade related and freight transport. So, shortening supply chains could reduce embedded emissions in the transport of goods, encouraging businesses to move supply chains closer to home and essentially meet the objectives.”

He added that there would, of course, be differences across different areas of the retail sector with an obvious example being electricals, where so much of what is sold in the UK being imported from China and the Far East. “We don’t necessarily have the capabilities to be able to scale that efficiently,” Richard commented.

There will also be pressures on ESG investors. “The retail boards will come under increasing pressure to tell a really compelling sustainability story. But currently, disclosures around ESG targets remain vague. They lack comparability so therefore there are going to have to be changes. Retail will always be under more pressure to pursue actionable outcomes to reduce their carbon emissions, and investors will demand greater visibility over these because their financing terms will increasingly hinge on being able to provide analysis on their ESG credentials. The influence of ESG rating providers will also increase in the coming years.”

He continued: “There’s rising demand from significant institutional investors to invest in ESG funds, but also from retail investors as well. As such, investors are looking to engage with products that do good and also deliver good returns as well. There have been over 360 ESG-related funds launched in 2019, up 2.5% on the previous year, generating £120 billion euros of investment. And these underlying trends towards ESG will sharpen the dialogue between borrowers and investors and will be increasingly dominated by ESG. And finally, and potentially the most important for driving the catalyst of change, could be consumer pressure. The sustainable production and consumption of product has grown in importance in terms of where the consumer wants to shop, and how they want to consume. Consumer awareness and their expectations of responsible and ethical practices from retail brands and governments are driving the change.”

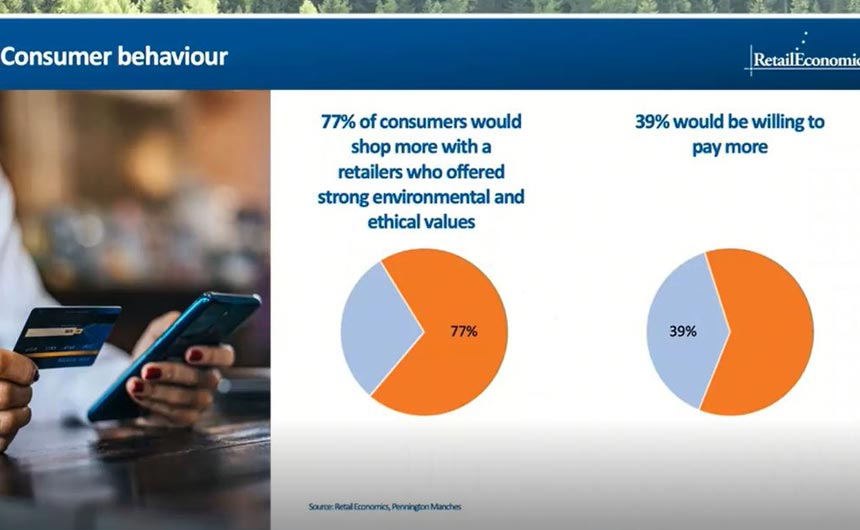

Focusing on the apparel market, his company’s research had shown that 64% of consumers believe that retailers and brands should take the responsibility for sustainable practices in the fashion industry, with only 19% of consumers stating that the responsibility lies with the consumer. Over three quarters of those surveyed (77%) said that they would shop with brands showing strong environmental and ethical values, but with only 39% willing to pay more for this sustainability assurance.

Richard believes the challenge to be a growing acceptance among consumers, especially Generation Z, to have more responsibility over their own actions in terms of the way that they consume.

“But there is also a big gap between intentions and behaviours, where the best laid plans of consumers are not always met by their behaviour. An element of this is definitely true when it comes to sustainability says Richard. “Retailers need to play a more proactive role to help consumers make the environmentally-friendly decisions, and also to nudge them to make the decision, because retailers play a crucial role in driving change. The underlying principles that retailers can adopt, and which some of them have already adopted, is that we can not only help to save the planet, but that we can use sustainability as an effective point of differentiation that is so desperately needed in today’s fiercely competitive market. For example, consumers need to default their delivery choices, offsetting their carbon emissions by choosing to wait for deliveries.”

He also highlighted the role of peers and social norms. “There is an enormous gap for retailers and brands to engage in sustainability-driven influencers. They need to promote the right behaviours and make sustainability behaviour a salient goal for consumers which is an area that can really deliver huge benefits.”

Summing up, Richard concluded: “Overall, I’m optimistic about the way that retailers can adapt, and about the challenges they are facing, while also keeping sustainability at the heart of what they are trying to do. The opportunity is there for retailers to gain that competitive edge and to put forward that point of differentiation to do the right thing while also delivering their commercial objectives.”