Matthew Macaulay, senior strategist at KI, on how licensing can offer financial brands opportunities to distinguish themselves in a crowded market.

“Why don’t we educate young people about money???” wrote an exasperated Steven Bartlett of Dragon’s Den, as he announced the opening of his ‘Money School’ last month. His new initiative aims to help kids from disadvantaged backgrounds learn about money, saving, investing, tax, credit and more.

Bartlett, like myself, is concerned about the financial illiteracy of entire generations of children. Unlike the Prime Minister, I believe a practical grounding in compound interest and learning the pitfalls and opportunities of the stock market will serve kids better than forcing them to learn Pythagoras Theorem until 18.

A2 + B2 certainly does not = a financially secure country of savers. In fact, a recent Money & Pensions Service Financial Wellbeing Survey, found that 15% of UK adults do not have savings of any kind and that 11.1 million adults do not save regularly. With children’s increasing financial empowerment, facilitated by digital devices and ready access to e-commerce services, the need for financial education has never been greater. We need to give children the skills to develop financial independence; children who can’t manage money, become adults who can’t manage money.

If the government is unwilling or unable to grasp the nettle of kids’ financial illiteracy, then savvy financial brands will identify the significant opportunity to step in and plug the gap. This is less a selfless act than an astute business move – there are plenty of studies which show that connecting emotionally with children during childhood fosters trust and loyalty which endures into adulthood. Cottoning on to this early connection will pay dividends later when they come to open their first bank account, ISA or select their first mortgage.

The slightly longer in the tooth readers might recall the NatWest Piggy Bank merchandise. Launched in 1983 and beloved by generations of children, kids received their first ceramic pig, Woody, when opening an account with £3 and as their savings grew, they received the other members of his piggy bank family.

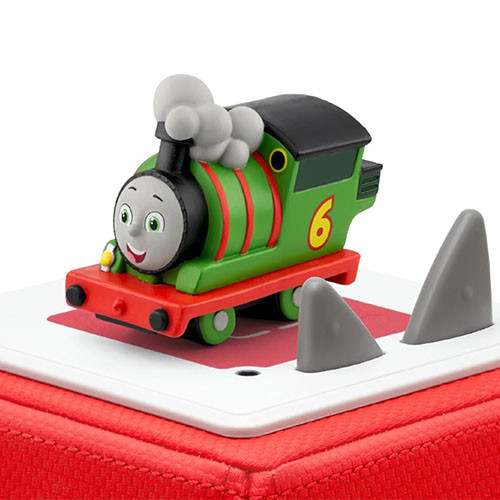

That simple act – conveying to kids the importance of saving and leveraging their desire to collect characters – was immensely popular and more than one million piggy banks were issued in the first two years, and indeed many of those pigs grew in value and achieve good returns on marketplaces to this day. Imagine the potential then today of children’s entertainment brands, such as Barbie or Bluey working in step with household financial brands and using their immense popularity across digital and physical touchpoints to get the key messages of financial education across. These could be powerful brand collaborations which would benefit both financial and entertainment brands by undertaking a genuine civic good.

Interested brands should look to the likes of the Royal Bank of Canada for example, which recently partnered with the Roblox game, Seaboard City – opening a virtual branch in the game in which children can undertake quests with Leo the Lion to teach them about saving. What a fantastic step forward.

RBC has correctly recognised that there will be a significant halo effect of being on the much-loved platform Roblox, as well as being in a popular game brand. This will be compounded by being one of the first financial brands in that ecosystem. They’ve also recognised that the interactive and immersive format will make learning about money fun, not a chore.

Financial services is a fast evolving area – with customers increasingly tempted to move from high street banks to challenger banks offering significant incentives to switch. Licensing can offer financial brands opportunities to distinguish themselves in this crowded market; helping children take their first financial steps and building fond memories will garner future loyalty. Those that recognise the opportunity to engage children in financial literacy are sitting on a potential gold mine.